Find 5x more buyers

include your low-rate mortgage in your home sale with HomeRate Advantage.

2 minutes, no obligation

Why sell with Homerate Advantage?

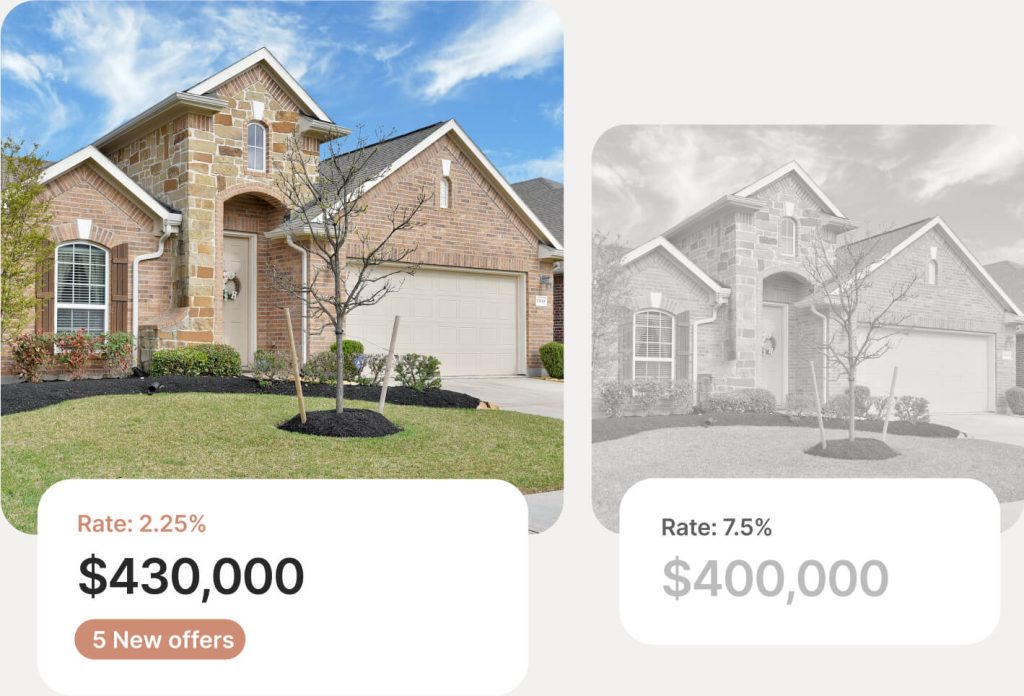

Reach more buyers who can afford your home when you include your mortgage in your sale

Sellers - Getting Started

HomeRate Advantage is your trusted partner for selling or buying a home with a low-rate assumable mortgage. We manage the assumption process from start to finish, enabling homebuyers to easily purchase their next home with a low-interest rate mortgage attached.

An assumable mortgage is a type of home loan that allows a homebuyer to take over the existing mortgage terms from the seller. All government-backed loans, such as FHA and VA loans, are eligible for assumption by law, and millions of these mortgages are available.

With today’s interest rates, including your low-rate assumable mortgage in your sale offers several benefits:

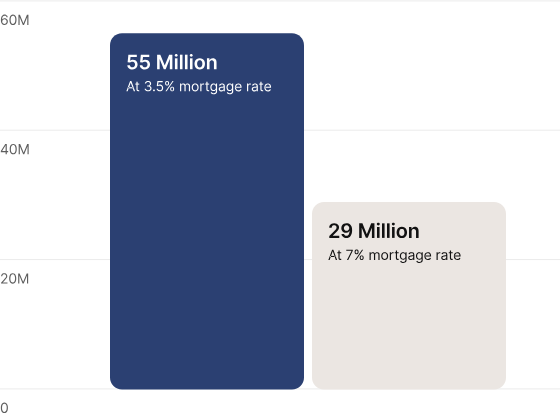

Larger buyer pool: Sellers that include a low-rate mortgage with their home can attract 5x more buyers that can afford their home.

Competitive advantage: The ability to assume a low interest provides an additional incentive to potential buyers, making your listing stand out in the market.

Higher proceeds: Once more buyers can afford your home, you’ll receive more offers and have a higher certainty of sale.

With interest rates at their highest in years, your low-rate mortgage is a valuable asset. HomeRate Advantage helps sellers effectively market their assumable mortgage to maximize exposure and reach up to 5x more buyers. Once an offer is accepted, we guide the buyer through the assumption process and manage the transaction for all parties involved, ensuring a smooth and timely closing. Plus, HomeRate Advantage is free for sellers and our 45-Day Closing Guarantee means you’ll close within 45 days, or we’ll cover your mortgage payment until we do.

HomeRate Advantage is free for sellers. HomeRate Advantage’s fee is 1% of the purchase price, which we collect from the buyer for our service through closing costs.

We’ll work with your listing agent to market your listing to buyers interested in assuming a low-rate mortgage. We can also provide your agent with additional marketing resources to include with your listing.

For sellers who don’t have a listing agent, we can recommend a highly trusted and qualified agent who will partner with Roam to sell your home along with your assumable rate mortgage.

When you work with HomeRate Advantage to facilitate a mortgage assumption, we guarantee that you will close in 45 days. If the home does not close within 45 days, we’ll cover your mortgage payments until it does, as long as the scheduled closing date is at least 45 days from the offer acceptance and you sign the Roam Seller Closing Guarantee. Just provide proof of mortgage payments made during this period, and we’ll handle the rest, ensuring prompt and accurate reimbursement.

Sellers - Assumption Process

To ensure the best results and benefits from a mortgage assumption, we currently require homes to have an assumable loan, such as an FHA or VA loan, which meet the following criteria:

You are current on your mortgage payments

Your remaining mortgage balance is at least 40% of the listing price

How do I find a buyer who qualifies for my loan?

HomeRate Advantage will work with you and your agent to market your listing and to make sure buyers understand the benefits of the assumable mortgage. We will then screen any interested parties on your behalf.

Once the mortgage is successfully transferred, your name will be removed from the mortgage. You will no longer be held liable or associated with the mortgage. Anything that occurs with the mortgage after the assumption will have no impact on you or your credit.

HomeRate Advantage will work with you and your agent to market your listing and to make sure buyers understand the benefits of the assumable mortgage. We will then screen any interested parties on your behalf.

In order for your VA loan entitlement to be released, your mortgage must be assumed by another qualified military buyer, or the loan must be completely paid off. This allows you to take out a new VA loan for your next home purchase. If you are looking to sell and want to maintain your entitlement, Roam will help market your home to qualified military buyers.

As part of the mortgage assumption process, the lender files for a release of liability of the loan when the mortgage is transferred to the new buyer. This means that you will no longer have any obligation for the loan, and your credit is untouched regardless of the subsequent buyer’s payments.

In addition to ensuring a smooth mortgage assumption process for the seller, HomeRate Advantage will recommend lenders who provide additional financing to the buyer if they do not have the cash to cover the remaining equity. With all mortgage assumption transactions, Roam ensures the seller’s equity is cashed out entirely at the time of closing.